Governance Tokens – Empowering Decentralized Decision-Making in Modern Finance

The cryptocurrency landscape has evolved dramatically since Bitcoin’s inception, introducing numerous innovations that have transformed how we perceive digital assets and decentralized finance. Among these groundbreaking developments, Governance Tokens have emerged as a pivotal technology that bridges the gap between traditional finance and decentralized autonomous organizations (DAOs). These sophisticated digital assets represent a fundamental shift in how blockchain-based platforms manage decision-making processes, offering token holders unprecedented control over protocol development and strategic direction.

Understanding Governance Tokens: The Foundation of Decentralized Democracy

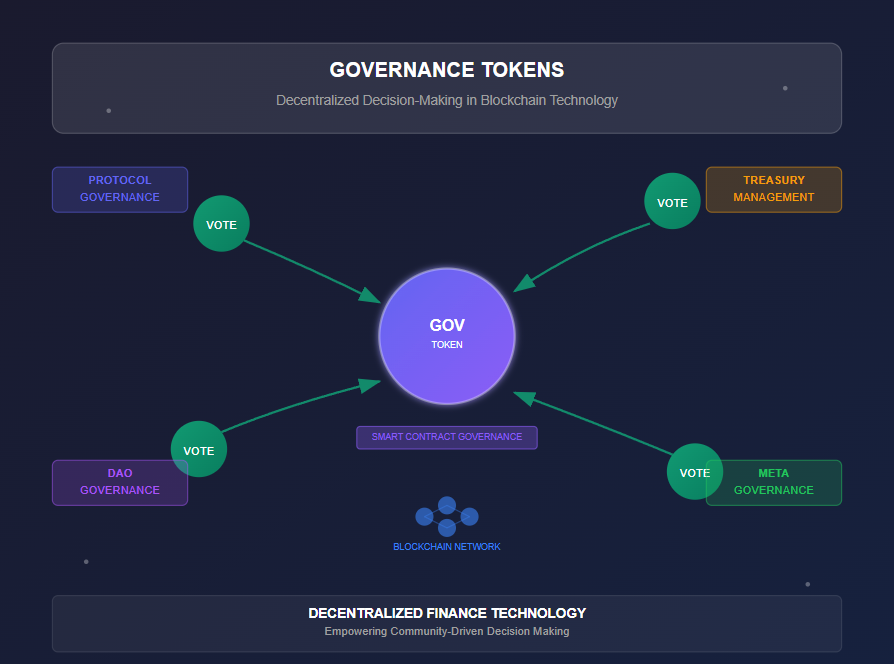

Governance Tokens represent a revolutionary approach to organizational management within the blockchain technology ecosystem. Unlike traditional cryptocurrencies that primarily serve as stores of value or mediums of exchange, Governance Tokens grant holders voting rights and decision-making power within decentralized protocols. This innovative technology enables communities to collectively govern blockchain projects, making crucial decisions about protocol upgrades, treasury management, and strategic partnerships without relying on centralized authorities.

The emergence of Governance Tokens reflects the broader evolution of decentralized finance (DeFi) technology, where community-driven governance has become essential for maintaining trust and transparency. These tokens leverage blockchain technology to create transparent, immutable voting systems that ensure every stakeholder’s voice is heard and recorded permanently on the blockchain.

In the context of modern finance, Governance Tokens represent a paradigm shift from traditional corporate governance structures. While conventional companies rely on shareholder meetings and board decisions, blockchain-based organizations utilize Governance Tokens to implement truly democratic decision-making processes. This technology enables real-time voting on proposals, automatic execution of approved decisions through smart contracts, and transparent tracking of all governance activities.

The Technology Behind Governance Tokens

The underlying technology that powers Governance Tokens is built upon sophisticated smart contract systems that facilitate secure, transparent voting mechanisms. These contracts automatically execute approved proposals when predetermined voting thresholds are met, eliminating the need for manual intervention and reducing the risk of human error or manipulation.

Most Governance Tokens utilize proof-of-stake consensus mechanisms, where voting power is proportional to the number of tokens held by each participant. This technology ensures that stakeholders with greater investment in the protocol have correspondingly greater influence over its direction, aligning incentives between token holders and the long-term success of the platform.

The smart contract technology underlying Governance Tokens incorporates multiple security layers to prevent manipulation and ensure fair voting processes. These include time-locked voting periods, minimum quorum requirements, and multi-signature validation systems that collectively enhance the security and reliability of the governance process.

Advanced Governance Tokens also implement delegation mechanisms, allowing token holders to delegate their voting power to trusted representatives or experts who can make informed decisions on their behalf. This technology addresses the challenge of voter apathy while maintaining democratic principles within the governance framework.

Types of Governance Tokens in Decentralized Finance

Protocol Governance Tokens

Protocol Governance Tokens represent the most common category within the DeFi ecosystem. These tokens grant holders direct control over protocol parameters, including fee structures, interest rates, and technical upgrades. Popular examples include Compound’s COMP token, Uniswap’s UNI token, and Aave’s AAVE token, each serving as the cornerstone of their respective governance systems.

The technology behind protocol Governance Tokens enables holders to propose and vote on changes that directly impact the protocol’s functionality and economics. This includes adjusting lending rates in DeFi platforms, modifying trading fees on decentralized exchanges, and implementing new features or security upgrades.

Protocol Governance Tokens often incorporate sophisticated voting mechanisms that require technical expertise to navigate effectively. The underlying technology includes proposal creation systems, voting delegation options, and automatic execution of approved changes through on-chain governance contracts.

Treasury Management Tokens

Treasury Management Tokens focus specifically on the allocation and management of protocol treasuries, which often contain millions of dollars worth of cryptocurrency assets. These Governance Tokens enable communities to make strategic decisions about fund allocation, investment strategies, and ecosystem development initiatives.

The technology supporting Treasury Management Tokens includes multi-signature wallet systems, budget tracking mechanisms, and transparent reporting tools that ensure accountability in fund management. This technology enables communities to allocate resources for development grants, marketing initiatives, and strategic partnerships while maintaining full transparency and accountability.

Treasury Management Tokens represent a significant advancement in decentralized finance technology, enabling communities to manage substantial financial resources without traditional corporate structures. The voting mechanisms ensure that treasury decisions reflect the collective will of token holders while implementing robust security measures to protect community funds.

Meta-Governance Tokens

Meta-Governance Tokens represent an advanced category that extends voting power across multiple protocols and platforms. These tokens leverage sophisticated technology to aggregate governance rights from various DeFi protocols, enabling holders to participate in governance decisions across an entire ecosystem of interconnected platforms.

The technology behind Meta-Governance Tokens includes cross-chain compatibility systems, automated voting delegation mechanisms, and sophisticated portfolio management tools that track governance positions across multiple protocols. This technology enables more efficient governance participation for users involved in multiple DeFi platforms.

Meta-Governance Tokens often incorporate AI-driven recommendation systems that help token holders make informed voting decisions across multiple protocols. This technology analyzes proposal complexity, potential impact, and community sentiment to provide valuable insights for governance participants.

The Role of Governance Tokens in Modern Finance

Governance Tokens have fundamentally transformed the relationship between service providers and users in the financial technology sector. Traditional finance relies on hierarchical decision-making structures where customers have minimal influence over product development and strategic decisions. In contrast, Governance Tokens democratize financial services by giving users direct control over platform development and policy decisions.

The integration of Governance Tokens into decentralized finance has created new models of stakeholder capitalism that align user interests with platform success. This technology enables users to become true owners of the financial services they utilize, creating stronger incentives for long-term engagement and platform improvement.

The technology underlying Governance Tokens has also introduced new concepts of value creation in finance. Token holders can directly influence platform profitability through governance decisions, creating alignment between user interests and financial performance. This represents a significant departure from traditional finance models where user and provider interests may conflict.

Governance Tokens have also facilitated the emergence of sophisticated financial instruments that would be impossible in traditional finance. These include dynamic fee structures that adjust based on market conditions, algorithmic monetary policies controlled by community governance, and innovative risk management mechanisms that leverage collective intelligence.

Technical Implementation and Smart Contract Architecture

The technical architecture of Governance Tokens relies on sophisticated smart contract systems that ensure secure, transparent, and efficient voting processes. These contracts implement complex logic for proposal creation, voting period management, quorum requirements, and automatic execution of approved decisions.

Modern Governance Token technology incorporates advanced cryptographic techniques to ensure voter privacy while maintaining transparency in voting outcomes. Zero-knowledge proof systems enable private voting while still allowing public verification of results, addressing concerns about voter coercion and privacy.

The smart contract technology supporting Governance Tokens includes sophisticated access control mechanisms that prevent unauthorized proposal creation while ensuring broad community participation. These systems often implement reputation-based proposal requirements, staking mechanisms for proposal creation, and time-locked execution periods for approved decisions.

Gas optimization represents a crucial aspect of Governance Token technology, as voting activities can become expensive during periods of network congestion. Advanced implementations utilize layer-2 scaling solutions, batched transactions, and efficient storage mechanisms to minimize costs while maintaining security and decentralization.

Economic Models and Tokenomics of Governance Tokens

The economic design of Governance Tokens plays a crucial role in their effectiveness and long-term sustainability. These tokens must balance several competing objectives: incentivizing active participation in governance, preventing plutocratic control by wealthy actors, and maintaining sufficient token distribution for meaningful decentralization.

Many Governance Tokens implement sophisticated tokenomics that reward active participation through governance mining programs. These systems distribute additional tokens to users who consistently participate in voting, propose valuable improvements, or contribute to community discussions. This technology helps maintain engaged governance communities while preventing voter apathy.

The technology behind Governance Token economics often includes dynamic supply mechanisms that adjust token issuance based on governance participation rates, protocol usage, and other relevant metrics. These systems help maintain optimal token distribution for effective governance while providing appropriate incentives for continued participation.

Advanced Governance Token models incorporate mechanisms for token burning or value accrual that tie token value to protocol success. This technology ensures that governance participants have financial incentives aligned with making decisions that benefit the overall ecosystem, creating sustainable economic models for decentralized governance.

Security Considerations and Risk Management

Security represents a paramount concern in Governance Token technology, as these systems control significant financial resources and critical protocol parameters. The technology must protect against various attack vectors including governance attacks, flash loan manipulation, and social engineering campaigns targeting token holders.

Multi-layered security architectures protect Governance Token systems through time-locked execution periods, minimum quorum requirements, and emergency pause mechanisms that can halt dangerous proposals. These security measures ensure that even if malicious actors acquire significant voting power, they cannot immediately damage the protocol or steal funds.

The technology underlying secure Governance Token systems includes sophisticated monitoring tools that detect unusual voting patterns, sudden token accumulation, and other indicators of potential governance attacks. These systems can automatically trigger additional security measures or community alerts when suspicious activity is detected.

Risk management in Governance Token technology also addresses the challenge of low voter turnout, which can make protocols vulnerable to governance attacks with relatively small token positions. Advanced systems implement mechanisms to increase participation through better user interfaces, delegation options, and incentive programs that encourage active governance engagement.

Integration with Traditional Finance and Regulatory Considerations

The growing adoption of Governance Tokens has attracted attention from traditional financial institutions and regulators, leading to discussions about how these innovative technologies fit within existing regulatory frameworks. The technology enables new forms of stakeholder engagement that challenge traditional concepts of corporate governance and securities regulation.

Financial institutions are increasingly exploring ways to integrate Governance Token technology into traditional finance products, creating hybrid systems that combine the benefits of decentralized governance with regulatory compliance. This technology enables new forms of investment products that give traditional investors exposure to decentralized finance governance while meeting regulatory requirements.

The regulatory landscape for Governance Tokens continues to evolve as authorities worldwide grapple with classifying these innovative financial instruments. The technology’s unique characteristics, which combine elements of securities, commodities, and utility tokens, require new regulatory approaches that balance innovation with investor protection.

Compliance technology for Governance Tokens is rapidly developing to address regulatory requirements while preserving the decentralized nature of these systems. This includes KYC/AML integration, geographic restrictions based on regulatory requirements, and reporting mechanisms that satisfy regulatory oversight while maintaining user privacy.

Future Developments and Technological Innovations

The future of Governance Token technology promises significant advances in user experience, security, and functionality. Emerging technologies including artificial intelligence, machine learning, and advanced cryptographic techniques will enhance the effectiveness and accessibility of decentralized governance systems.

AI-powered governance assistants represent an exciting frontier in Governance Token technology, offering personalized recommendations based on individual preferences, portfolio composition, and risk tolerance. These systems will help democratize access to effective governance participation by reducing the technical expertise required to make informed voting decisions.

Cross-chain governance technology is evolving to enable Governance Tokens to operate across multiple blockchain networks, creating more inclusive and comprehensive governance systems. This technology will enable unified governance across entire ecosystems of interconnected protocols and platforms.

The integration of privacy-preserving technologies will enhance Governance Token systems by enabling confidential voting while maintaining verifiable outcomes. Advanced cryptographic techniques will allow token holders to participate in governance without revealing their identities or token holdings, addressing concerns about voter coercion and privacy.

Impact on Decentralized Autonomous Organizations (DAOs)

Governance Tokens serve as the foundational technology for Decentralized Autonomous Organizations, enabling these entities to operate without traditional management structures. The technology facilitates complex organizational decisions through democratic voting processes that can manage everything from hiring decisions to strategic partnerships.

The evolution of DAO technology has been closely intertwined with advances in Governance Token systems, as these organizations require sophisticated governance mechanisms to function effectively. Modern DAO technology incorporates advanced proposal systems, multi-stage voting processes, and automatic execution of approved decisions through smart contract technology.

Governance Tokens have enabled DAOs to scale beyond simple voting mechanisms to include complex organizational structures with multiple working groups, specialized committees, and hierarchical decision-making processes. This technology supports sophisticated organizational designs while maintaining transparency and democratic accountability.

The success of major DAOs has demonstrated the viability of Governance Token technology for managing large organizations and substantial financial resources. This has attracted traditional organizations to explore implementing similar technology for internal governance and stakeholder engagement.

Market Dynamics and Investment Considerations

The market for Governance Tokens has experienced significant growth as investors recognize their unique value proposition within the broader cryptocurrency ecosystem. Unlike purely speculative assets, Governance Tokens derive value from their utility in controlling valuable protocols and their ability to generate returns through governance decisions.

Investment in Governance Tokens requires understanding both the technology underlying the tokens and the fundamentals of the protocols they govern. This dual nature creates complex valuation models that consider both token mechanics and protocol performance, requiring sophisticated analysis techniques.

The technology enabling Governance Token markets includes specialized trading platforms, derivatives markets, and lending protocols that treat these tokens as collateral. This infrastructure supports liquid markets while enabling new financial products based on governance rights.

Market dynamics for Governance Tokens are influenced by factors unique to decentralized finance, including protocol usage metrics, governance activity levels, and the overall health of the DeFi ecosystem. Understanding these dynamics requires expertise in both traditional finance and blockchain technology.

Educational Resources and Community Building

The complexity of Governance Token technology necessitates comprehensive educational resources to ensure broad community participation in governance activities. Successful protocols invest heavily in creating accessible documentation, tutorial content, and community support systems that lower barriers to governance participation.

Community building around Governance Tokens requires technology platforms that facilitate discussion, collaboration, and knowledge sharing among token holders. These platforms often integrate with voting systems to create seamless experiences for governance participants.

The technology supporting governance education includes simulation platforms where users can practice voting and proposal creation without financial risk, comprehensive analytics dashboards that explain voting outcomes and their implications, and notification systems that keep community members informed about important governance activities.

Building successful governance communities requires balancing technical sophistication with accessibility, ensuring that both expert developers and casual users can meaningfully participate in protocol governance. This challenge has driven innovation in user interface design and community engagement tools.

Conclusion: The Future of

Governance Tokens represent a fundamental innovation in both blockchain technology and modern finance, creating new models for organizational management and stakeholder engagement. These sophisticated digital assets have demonstrated their ability to manage complex protocols, allocate substantial resources, and coordinate community activities at a scale previously impossible without traditional corporate structures.

The technology underlying Governance Tokens continues to evolve rapidly, incorporating advances in security, user experience, and cross-chain compatibility that will expand their capabilities and adoption. As traditional financial institutions and regulators develop frameworks for integrating this technology, Governance Tokens are positioned to play an increasingly important role in the broader financial ecosystem.

The success of Governance Tokens in decentralized finance has created a template for democratic governance that extends far beyond cryptocurrency applications. This technology offers valuable lessons for any organization seeking to increase stakeholder engagement, improve transparency, and create more responsive governance systems.

As the technology matures and regulatory clarity improves, Governance Tokens will likely become standard components of digital financial services, enabling new forms of customer engagement and value creation. The ongoing development of this technology promises to further democratize finance while creating more efficient and responsive financial systems.

The future of Governance Tokens lies in their ability to balance technological sophistication with accessibility, creating systems that harness collective intelligence while maintaining security and efficiency. As this technology continues to evolve, it will undoubtedly play a crucial role in shaping the future of both decentralized finance and traditional financial services.

Read more : The Main Types of Crypto Assets